Tax Resolution

Specialist

Facing trouble with the IRS? Let a tax resolution specialist handle the pressure and find a favourable outcome for you.

Facing trouble with the IRS? Let a tax resolution specialist handle the pressure and find a favourable outcome for you.

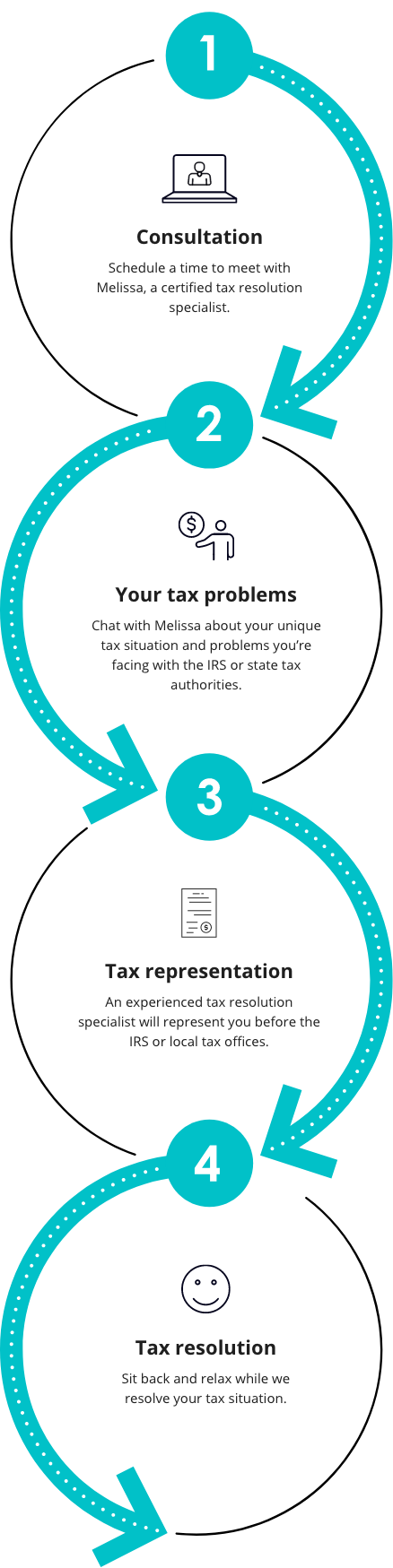

There are over fifty million taxpayers in need of tax resolution services. You don’t have to be one of them. Whether it’s your business, or you as an individual taxpayer, take yourself out of the crosshairs of the IRS with our tax representation services. A tax resolution specialist can help you with penalties, audit representation, and a range of other services. We handle your case from start to finish.

Our tax resolution specialists provide services to any American citizen, business or corporate that is facing problems with the IRS. We provide services online, across all 50 states.

Testimonials

NEED CONTENT

Our IRS tax audit representation typically entails:

A tax resolution specialist serves as your representative and communicates with the IRS on your behalf. We will handle all correspondence, inquiries, and requests from the IRS and ensure that all required documents and information are provided in a timely and appropriate manner.

A tax audit representative will gather and organize your financial records, receipts, and other supporting documentation related to the audit. We will review these documents to ensure that they are complete, accurate, and appropriately support the items being audited.

A tax resolution specialist will attend the audit meetings and hearings on your behalf. We will present your case, respond to the IRS’s questions, and provide explanations or clarifications as needed. Our goal is to alleviate your stress and ensure that your rights are protected throughout the process.

If any issues or discrepancies are identified during the audit, your tax resolution specialist will work with the IRS to negotiate a resolution. We will analyze the audit findings, identify potential options for resolution, and help you understand the available choices. We will always advocate for your best interests, aiming to minimize any additional taxes, penalties, or interest that may be assessed as a result of the audit.

Our certified tax resolution specialists have undergone specialized training and education in tax laws, regulations, and procedures. We have in-depth knowledge of tax codes, IRS policies, and various strategies for resolving tax issues.

Our expertise allows us to represent you well before the IRS, identify potential solutions, and give you accurate advice.

Dealing with tax problems can be overwhelming and stressful. Our certified tax resolution specialists can act as your advocate and provide representation in dealings with the IRS or state tax authorities. We know how the IRS works and can provide strategies that minimize your tax liability, penalties, and interest.

With an experienced tax specialist by your side you can greatly increase your chances of achieving a favorable resolution and relieving the burden of dealing with tax issues personally.

Fill in the form below and we will get back to you.

Want to stay up to date with tax changes that impact you and your business? Subscribe to our mailing list.

About Us

Blogs

Testimonials

Services

Client Portal

Terms & Conditions

Privacy Policy